Is Your Agency's Pricing Competitive?

Whether you’re a newbie just starting out or a busy veteran steadily chugging along, pricing is one area of your business that you must get right.

Price too low and your agency won’t make enough to support itself. Your team will feel as if they’re working for free and closing shop will seem inevitable.

But if you aim too high, you’ll also wind up with a similar result: Not having enough clients willing to pay your steep rate. Paying your bills will get harder every month as your high rate scares away customers.

Unfortunately, trying to avoid both of these ends means you may find yourself comfortably settled somewhere in a “safe” middle ground that keeps you floating along without really increasing your profits by much.

To avoid all three unwanted scenarios, you’ll need to evaluate your agency’s rate to see just how competitive it really is. Luckily, we’ll show you just how to do that in today’s article.

Perform Your Market Analysis Efficiently

This is just a fancy way of saying you need to scope out your competition (without spending too much time doing so).

To do this, identify your real competitors in your niche. We’re talking about comparing apples to apples here. No apples to oranges funny business.

So, for example, if the agencies in your area focus on SEO or social media and yours is mainly focused on building robust websites, you cannot consider those agencies true competitors.

Yes, on the surface they are an agency like you, but if their services are completely different, their rates will be—and should be—different too.

With that said, your first step is to find the true “apples” in your local area. Look for agencies that are roughly the same size as yours and offer an almost identical list of services to yours.

It’s important to start locally since your expenses include overhead costs, such as rent or high taxes, which are similar and thus comparable in your specific area.

Once you have your competitors in the local area narrowed down, you can spread out your geographic search zone to get a general idea of what the going rate is outside of your service market for comparison’s sake.

Next, take a peek at your competitor’s unique selling proposition (if you can spot it, of course).

Are they offering additional services for the same rate as your agency? Are they priced competitively? Why would someone choose their service over yours?

Answer these questions honestly and factor these considerations into your pricing strategy.

After all, the goal here is not to price match or start a lowest price bidding war. Instead, you’ll just want to use these items to justify your competitively-priced bundle.

Understand Your True Costs

Now that you know what the market’s like for other agencies in your area, let’s find out your true cost of doing business. Keep in mind that rough estimates won’t cut it here so get out your calculator.

HubSpot mentions three areas to focus on when it comes to calculating your agency’s true costs:

- Hours of effort involved

- Overheads atop of the salaries you pay

- Utilization rate of your employees

You should have a good idea of the first two figures by now so we’ll skip ahead to the one that’s often miscalculated: The utilization rate of your employees.

While your employees technically work an eight-hour day, you’re really only seeing roughly six hours of client facing (or billable) work—a 75–80% utilization rate, as pointed out in that HubSpot article.

But your agency is still paying for those two hours of non-billable work. Only now you won’t have revenue generated by that employee to offset the costs.

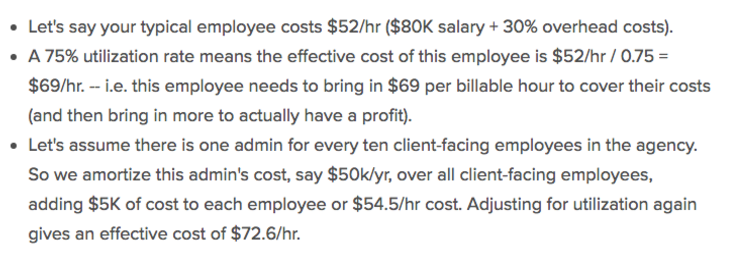

Your rates need to account for this fact or your agency won’t see the healthy profits it needs to grow. To do this, take a look at this example from HubSpot:

Image Source: HubSpot

Try using this math with the employees on your payroll to understand their true utilization rate.

Focus on Value Added vs. Billable Hours

Now, you’re probably thinking, Why did we just calculate our hourly utilization rate if we’re not charging billable hours?

And the answer is, because you still need to keep this figure in the back of your mind.

Remember when we said that if you charge too little you won’t stay in business for much longer?

Charging a price based on value added won’t help if you’re not at least covering your costs. So this hourly figure is important, but it’s not a set rate to charge since there are so many other variables to add to your baseline. Once you have a rate that reflects this, then you can move on to pricing by value.

To do this, you need to figure out the costs of acquiring a customer and the lifetime value of having one. You’ll find this out for each client you currently or intend to work with.

These two metrics will help you determine what value you bring to the table in the eyes of your clients.

For example, if one website lead earns a client $6,000 in services, a proposal priced around half of that ($3,000) isn’t too unrealistic, especially if their current cost of acquisition is around $4,000.

This also frames the sale in terms of: You’re paying me to drive qualified leads your way instead of just building a new website to do so.

It’s like saying, “Hey! We’re on the same team here and I want to help you acquire a home-run lead.”

What client wouldn’t want to hear this?

But think about what would happen if you simply stated that a new website runs around $3,000 based on hours and costs. Your services would only be viewed as a commodity that can be price shopped and undercut by competitors—which is exactly what you don’t want.

Understanding the lifetime value of a customer is also important since some clients may not see a return until a few consistent purchases are made by their newly acquired visitors.

In these cases, you’re likely to pay a higher acquisition cost initially that eventually evens out in your favor the longer the customer stays on board. This is why it’s essential to consider both of these figures any time you’re pricing your services.

Now, these statistics will need to come from your client in order for them to be accurate so you’ll want to ask them for these before you start discussing project numbers.

It’s also a good idea to understand how your client arrived at these figures to make sure they are in fact accurate. You don’t want to base your pricing on a number that isn’t exactly right, so it pays to double check for your own safety.

While this pricing strategy requires a bit more effort and thought, it will certainly pay off in the short and long term.

See, when you create standard, cookie cutter rates, you’re bound to find yourself earning healthy profits on some projects while others actually start to cost you. This unhealthy balance will eventually snowball and make financial matters worse for your agency. That’s why pricing on value makes much more sense.

Of course, for this to work, you’ll still need to factor in your hourly rate (including utilization buffers) to ensure that the value you provide makes sense for both parties.

Repeat this process every six months to a year to ensure that your pricing structure is always competitive and you’ll see profits pile up in no time.